Investing is a key part of securing your financial future, but with so many options out there, it can be tough to know where to start. Two of the most popular investment vehicles are mutual funds and exchange-traded funds (ETFs). While they share some similarities, they each come with distinct features that can impact your overall investment strategy. So, how do you decide which is right for you? Let’s break down the differences between these two investment choices to help you make an informed decision.

What Are Mutual Funds?

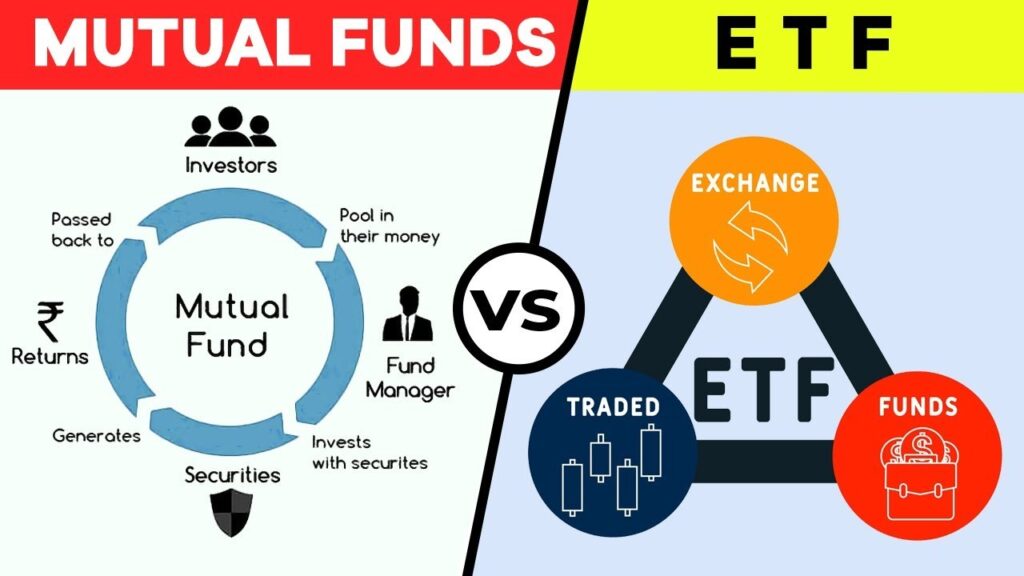

Mutual funds are essentially a pool of money collected from many investors to invest in a diversified portfolio of assets. These assets can range from stocks and bonds to other investment products. Mutual funds are usually managed by a professional fund manager who makes decisions on which securities to buy and sell based on the fund’s goals. Investors in a mutual fund own shares in the fund, but they don’t directly own the underlying assets.

Key Features of Mutual Funds:

- Professional Management: A portfolio manager makes the investment decisions. This means your money is being handled by someone with expertise, although it can come at a higher cost.

- Diversification: Mutual funds allow you to invest in a wide range of securities, which helps spread risk. For example, a stock mutual fund might hold shares of hundreds of companies across different sectors, reducing the risk of losing money if one sector underperforms.

- Accessibility and Minimums: Many mutual funds have minimum investment amounts, which can range from a few hundred to a few thousand dollars. This may make them less accessible for smaller investors.

- Pricing: Mutual fund shares are priced once at the end of each trading day based on the fund’s Net Asset Value (NAV). So, if you buy or sell shares, the price is set at the close of trading.

- Fees: Mutual funds tend to have higher fees, especially if they are actively managed. These fees include management fees, and in some cases, “load” fees (which are charges for buying or selling the fund).

What Are Exchange-Traded Funds (ETFs)?

ETFs, like mutual funds, pool money from investors to create a diversified portfolio, but they have some key differences. ETFs are typically designed to track the performance of a specific index, like the S&P 500, or focus on a specific sector, industry, or asset class. Unlike mutual funds, ETFs are traded on the stock exchange just like individual stocks.

Key Features of ETFs:

- Passive Management: Most ETFs are passively managed, meaning they track an index or a set of securities rather than trying to beat the market through active stock picking. As a result, ETFs often have lower fees than mutual funds.

- Liquidity and Flexibility: ETFs can be bought and sold throughout the day on the stock exchange, just like stocks. This allows you to take advantage of market movements during the trading day, something you can’t do with mutual funds since they are priced only at the end of the day.

- Low Costs: Since most ETFs are passively managed, they tend to have lower expense ratios than actively managed mutual funds. This means you pay fewer fees over time, which can add up to significant savings.

- Tax Efficiency: ETFs are often more tax-efficient than mutual funds because of their structure, which allows investors to avoid triggering capital gains taxes when they buy or sell shares.

- Transparency: ETFs provide real-time prices and typically disclose their holdings regularly, so investors always know what they’re invested in.

Key Differences Between Mutual Funds and ETFs

Understanding the differences between mutual funds and ETFs can help you decide which is better suited for your investment strategy.

1. Active vs. Passive Management

The primary difference between mutual funds and ETFs lies in management. Mutual funds can be actively managed, meaning fund managers are constantly buying and selling securities in an attempt to beat the market. On the other hand, most ETFs are passively managed, meaning they aim to replicate the performance of an index, such as the S&P 500, rather than outperform it.

- Active Management in Mutual Funds: Active management can lead to higher returns, but it also comes with higher fees. A manager might make quick changes to the portfolio based on market conditions, which could benefit you if the market moves in your favor. However, these decisions come at a cost.

- Passive Management in ETFs: ETFs are typically designed to follow an index. For example, a stock market index ETF will track the S&P 500, meaning it holds the same stocks in the same proportions as the index. The goal is not to beat the market, but to match its performance. This strategy typically results in lower management fees, but you might miss out on gains from actively managed stock picking.

2. Costs: Fees and Expense Ratios

One of the most significant differences between mutual funds and ETFs is their cost structure.

- Mutual Funds Fees: Mutual funds often charge higher fees, particularly if they are actively managed. These fees can include management fees, as well as load fees (which are charges for buying or selling the fund). Actively managed funds can have expense ratios over 1%, which may reduce your returns over time.

- ETFs Fees: ETFs are usually much cheaper to own. Since most ETFs are passively managed, they typically have expense ratios under 0.5%. Many ETFs also don’t charge commissions for buying or selling, especially if you use a commission-free brokerage. This can save you a significant amount in fees over time.

3. Liquidity and Trading Flexibility

ETFs offer more liquidity compared to mutual funds because they can be traded throughout the day. This gives you the flexibility to buy or sell shares at any time during market hours. If the market experiences a significant shift, you can adjust your position immediately.

In contrast, mutual funds are priced at the end of the trading day based on the NAV. This means you won’t know exactly what price you’re paying or receiving for your shares until after the market closes, which can be limiting if you want to react to news or events during the day.

4. Tax Efficiency

ETFs are generally more tax-efficient than mutual funds. The way they are structured allows for fewer taxable events. In simple terms, if you sell shares of an ETF, the transaction can happen without triggering capital gains taxes for other investors in the fund. This makes ETFs more attractive to investors who are focused on minimizing their tax liability.

On the other hand, mutual funds may distribute capital gains to investors if the fund manager sells securities within the fund at a profit. These distributions can be taxed, even if you didn’t sell any of your own shares, which makes mutual funds less tax-efficient.

5. Minimum Investment Requirements

Mutual funds often have minimum investment requirements, which can range from $500 to $3,000 or more. This might be a barrier for smaller investors who don’t have the capital to meet these requirements.

ETFs, however, don’t have minimum investment requirements other than the price of one share. If an ETF share costs $50, for example, you only need $50 to get started, making them more accessible to smaller investors.

6. Diversification

Both mutual funds and ETFs provide diversification, but the methods differ.

- Mutual Funds: Actively managed mutual funds can offer more tailored diversification because the portfolio manager may make adjustments to the fund’s holdings based on current market conditions. This flexibility can help reduce risk, but it also involves more complex decision-making and higher fees.

- ETFs: Most ETFs simply replicate an index, which means they offer built-in diversification by holding the same assets in the same proportions as the index. While they don’t provide the same level of active management, ETFs still allow you to invest in a broad range of securities.

Which is Right for You?

The decision between mutual funds and ETFs comes down to your investment goals and preferences. Here’s a quick guide to help you decide:

- Choose Mutual Funds If:

- You prefer active management and want a professional to handle your investments.

- You are comfortable with paying higher fees for the potential of outperformance.

- You don’t mind the once-a-day pricing and are investing for the long term.

- Choose ETFs If:

- You want to keep costs low and are okay with passive management.

- You want the flexibility to buy and sell throughout the day.

- You prefer a tax-efficient investment that tracks an index.